by Meghan Homsher and Ernie Stawser, Senior Analytics Advisors, Frontline

School district superintendents, treasurers, board members, and even county auditors and legislators may hear this question frequently over the next several months.

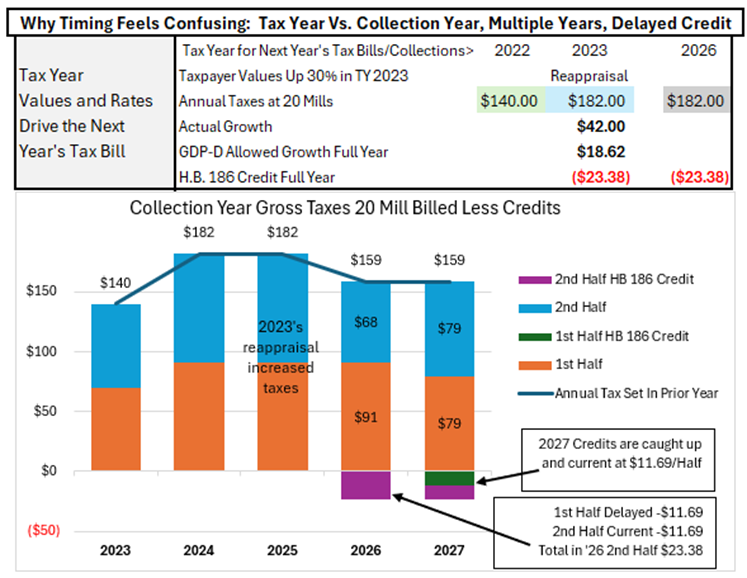

This graphic illustrates how a single Tax Year change can affect tax bills across multiple years because property taxes are calculated in one year and billed later.

The Tax Year portion shows when property values change and the annual tax amount is established.

The Collection Year portion shows how that same tax amount appears on bills, split into a 1st-half and 2nd-half bill.

The key point is that calculation and billing occur on different timelines.

Why the bill does not match the year on the notice

When property values increase due to reappraisal, the resulting tax increase is calculated in the Tax Year. Taxpayers then pay that amount later, in the next Calendar/Collection Year, typically in two installments.

As a result of reappraisal, the taxpayer’s bill increased starting in tax year 2023. Because the district was on the 20-mill floor, taxes increased 30%, from $140 to $182. The allowed growth was only $18.62, so the taxpayer is entitled to a credit of $23.38.

Credits are applied at billing, not at calculation. In the first half of 2026, tax bills were issued before the new legislation’s credits could be applied, resulting in a first-half bill of $91 with no credit reduction.

When the second-half bill is issued, the taxpayer receives the full year’s credit of $23.38, reducing that bill to $68. The relief is real, but it is concentrated into one billing period.

Why the next year can feel like a tax increase

The messaging challenge is amplified in the first half of 2027, when the bill totals $79. Many taxpayers may feel this is a tax increase, especially since the last bill they paid (second half of 2026) was only $68.

Once that timing effect passes and credits are no longer concentrated in the bill, payments return to reflecting the underlying tax. This can feel like a tax increase, even though no new tax was approved and no rate was changed.

This timing dynamic is a frequent source of confusion for taxpayers and a recurring communication challenge for school districts.

This does not mean:

• A new tax was approved

• The school district raised tax rates

• A credit was reversed or taken away

It means:

Taxes were calculated earlier, credits were applied later, and billing timing made the changes appear uneven.

In a subsequent article, we will review cash flow implications for districts.