by Ernie Strawser, Senior Advisor, Analytics Frontline Education

The Ohio K12 calculated formula assumes local revenue districts cannot legally bill or collect. This mathematically inflates the local share while reducing state revenue to schools. The result can be increased pressure on local taxpayers to levy additional taxes, and/or for district leaders to cut students’ educational programs.

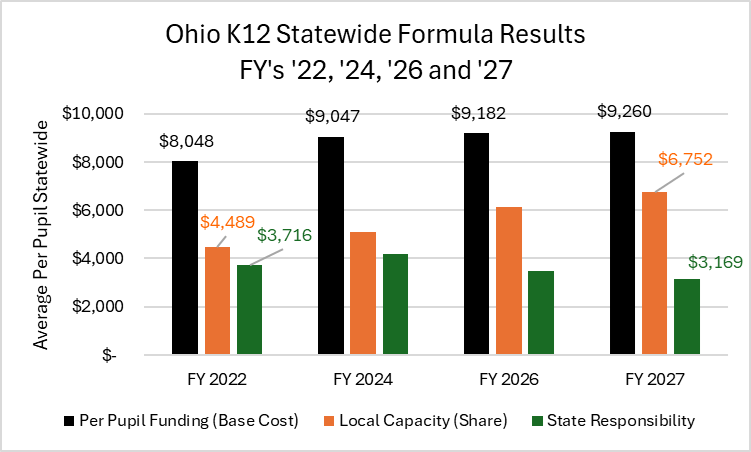

The formula is based upon a partnership between state funding and local funding. Calculated state revenue to schools begins with a per-pupil base cost to educate a student. The statewide average amount in FY 2027 is about $9,260. Base cost is then reduced by the formula-assumed local share of revenue. The remainder is then considered the state’s share of the per-pupil revenue - a higher local share decreases the state's share of revenue to schools.

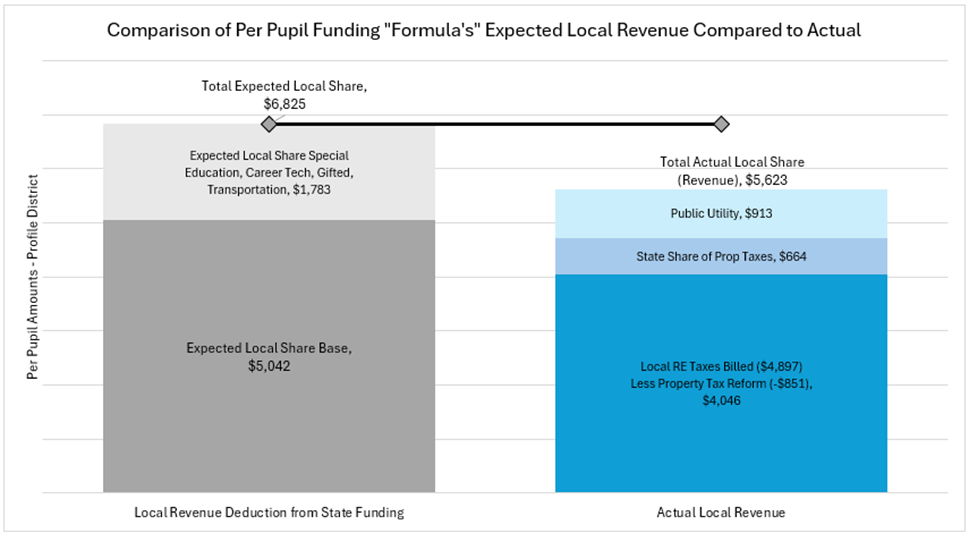

A structural deficit between formula-assumed and actual collectible local revenue shortchanges students. In the graph above, the profile district is at the state’s minimum local property tax rate (20 mills, to be eligible for state funding). The state’s formula assumes local revenue of $6,825, which exceeds the legally billable tax amount of $5,623 by about $1,200 (17%). Recently enacted property tax reform contributes to the $1,200 gap, as it reduces this district’s legally-billed local taxes by about $851. Rising assumed capacity vs. declining legal capacity is contradictory and contributes to the $1,200 structural imbalance in formula-assumed local revenue per pupil.

Base Cost Per Pupil and State Per Pupil Funding

When formula-assumed local revenue increases, and base cost remains flat, the result is less formula state revenue to districts. Statewide, the Base Cost Per Pupil was not recalculated for FY 2026 and therefore changed very little (only for enrollment impact) from FY 2024 ($9,047) to FY 2026 ($9,182), only about 1.5%. Assumed local revenue is based upon a capacity factor, property values, and taxpayer incomes. Post-pandemic property value inflation has contributed to a 50.4% increase in formula-assumed local revenue in FY 2027 compared to FY 2022’s $4,489. For the same period, base cost per pupil increased 15.5%. This structural imbalance contributes to formula per pupil revenue from the state decreasing by over $500 per pupil. This result puts added pressure on local taxpayers who are asked to fill in the ever-reducing state revenue per pupil.

This analysis illustrates formula results and some of the factors contributing to the formula not working for more than half of Ohio’s schools in FY 2027. Because of a long history of Ohio’s K12 funding formula ‘not working’ for many districts, guarantees have been in place. These guarantees mask formula imbalance by guaranteeing each district state revenue at FY 2020 or FY 2021 levels.

In conclusion, while property tax reform is a worthy cause, to do so in isolation contributes to a non-working state funding formula. By allowing inflationary property values to increase formula-assumed local revenue and reducing the legal ability to collect that revenue, the structural imbalance worsens. Absent adjustment, Ohio’s funding system will increasingly transfer responsibility from the state to local district taxpayers and budgets (services to students).