Co-Authored by Michelle Hillstrom

Equifax, Experian, and TransUnion are to a personal credit score as Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Global Ratings (“S&P”), and Fitch Ratings Inc. (“Fitch”) are to a school district credit rating. These institutions translate our complex life experiences into a more or less objective scale that then determines parts of our financial lives. A school district’s credit rating, similar to a personal credit score, is one of the most important determinants of borrowing costs and maybe a source of community pride. The following article describes (1) background on Moody’s major new rating methodology applicable to U.S. K-12 public school districts, (2) expectations for Moody’s new methodology, and (3) the potential impacts of Moody’s new methodology on Ohio public school districts borrowing costs and public relations.

The majority of Ohio public school districts are assigned a rating by Moody’s, although S&P and to a lesser extent, Fitch, rate Ohio’s school districts, too. As of January 1, 2021, Moody’s has approximately 310 Ohio school district ratings in their catalog. Throughout the years, Moody’s, as well as the other rating agencies, have changed their rating methodologies in order to reflect an evolving world. Each agency's methodology is the framework for a rating; that is, their methodologies are blueprints used for assessing creditworthiness and risk. In November 2020, Moody’s publicly announced that in the first quarter of 2021 a new rating methodology related to public school districts would be published. For the time being, ratings for K-12 public school districts continue to be governed by Moody's existing methodologies.

The existing methodologies that Moody’s uses to assign ratings for Ohio public school districts were known as (1) “U.S. Local Government General Obligation Debt” and (2) “Lease, Appropriation, Moral Obligation and Comparable Debt of U.S. State and Local Governments.” The former was the methodology employed for Ohio public school districts voted and unvoted bond issues as well as tax anticipation notes secured by a permanent improvement levy. The latter was the methodology employed for Ohio public school districts' certificates of participation transactions.

These existing or soon-to-be “old” methodologies are ‘security’ specific (e.g., general obligation vs. certificates of participation). The new methodology is ‘sector’ specific, which is meant to indicate that the methodology only applies to public school districts rather than, for example, cities, counties, and states. Moody’s has sector-specific rating methodologies for higher education, utilities, and transportation as well as other sectors, so the introduction of a public school district methodology is understandable.

In a “Request for Comment” published in June 2020, Moody's requested comments from the public on this newly proposed K-12 methodology. In response to comments received, Moody's is making changes to the planned implementation of the methodology. The changes have yet to be publicly announced; nevertheless, the “Request for Comment” includes clues that can help Ohio school districts prepare for the forthcoming methodology. Importantly, the “Request for Comment” states the following:

“We [Moody’s] expect that up to 20% of outstanding ratings for U.S. K-12 public school districts may change. Approximately half of the rating changes would be upgrades and half downgrades. The majority of rating changes would be by one notch.” – U.S. K-12 Public School District Methodology Request for Comment (June 22, 2020).

If Moody’s expectation that 20% of outstanding ratings may change is applicable to Ohio’s 310 public school districts with a Moody’s rating, then we may expect approximately 60 Ohio districts to experience a rating change. Those school districts who experience a rating change should consider consulting their underwriter, bond counsel, or municipal advisor regarding the relationship between the rating change and continuing disclosure requirements.

The new methodology includes four key goals: (1) distinguishes K-12 issuers from other governmental entities due to their unique credit drivers, (2) introduces assignment of an Issuer Rating for each school district reflecting its intrinsic credit strength absent the benefit of legal structure and pledged security, (3) assigns ratings for all general obligation and lease debt (e.g., certificates of participation) instruments in relation to the Issuer Rating, and (4) introduces updated analytic factors applicable to the K-12 universe.

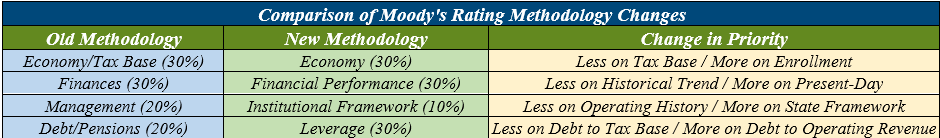

The updated analytic factors include four key changes that are illustrated in the following table. The columns entitled “Old Methodology” and “New Methodology” include the old and new names of the four key factors and their respective old and new weighting. The column entitled “Change in Priority” indicates the general change in priorities from the old to the new methodology. For example, the old methodology included a factor named “Economy/Tax Base” that accounted for 30% of the total rating. That factor was then divided into three sub-factors (tax base value, tax base value per capita, and median family income) that were each weighted 10%. The new methodology’s title for the same factor is simply “Economy” and includes only two sub-factors (median household income and a three-year compound annual growth rate in enrollment) that will account for 20% and 10% of the total rating, respectively.

The new methodology is a major update, not only because it is Moody’s first methodology specifically for public school districts, but also because the new methodology places a significantly higher priority on socioeconomic statistics and enrollment trends compared to the old methodology that prioritized tax base size. Moody’s justification for this change is that median household income and enrollment are more useful indicators of a school district economy as well as better predictors of credit stress. This specific change will affect school districts across Ohio differently with districts in high or modest population growth areas likely benefitting and the opposite being true of districts with low population growth or declining population.

Please consider contacting your underwriter or municipal advisor to acquaint yourself with the new methodology. The new methodology is important not only for school districts with an outstanding Moody’s rating but also for school districts who may be assigned a Moody’s rating in the future. School districts, for example, expecting to be assigned a Moody’s rating in Q1 or Q2 2021 may coordinate with their finance team and consider how their credit rating presentation should change to reflect the new methodology. Additionally, if a school district receives an unexpected downgrade during financing because of Moody’s new methodology the use of a bond insurer such as Build America Mutual or a credit enhancement provider such as the Ohio School District Credit Enhancement Program may be worth considering. Alternatively, if a school district is upgraded then such an upgrade is an opportunity to share the good news with the public. Typically, a credit rating upgrade, all other things being equal, is likely to lead to decreased borrowing costs whereas the opposite is true of a credit rating downgrade.

A good understanding of the new methodology will help you tell Moody’s the story of your school district. The story of your district is translated through Moody’s methodology and the result is a credit rating that underwriters like Stifel share with investors that ultimately, in addition to other details, determine the interest rate on your financing or refinancing. The proper bond market professionals can help you understand this new Moody’s methodology and its impacts on your financings regardless of whether you have a little or a lot of experience in the municipal bond market. Lastly, please note that entering into publicly issued financial obligations and engaging a rating agency or agencies should only be undertaken after careful consideration of all the options available to a school district.

The expectations above are preliminary and subject to change. As noted previously, the new methodology will be publicly released, according to Moody’s, in the first quarter of 2021, and that public release will include the details of the new methodology.

Steve Mahr is Assistant Vice President at Stifel, Nicolaus & Company, Incorporated.

614.453.9541 | mahrs@stifel.com

Michelle Hillstrom is Managing Director at Stifel, Nicolaus & Company, Incorporated.

216.592.6809 | hillstromm@stifel.com